Programs

Programs

Wisconsin School Choice Programs

Click the button below to begin enrolling your child in a choice school.

Enroll Your Child in a Choice School

English |

Español |

View Income Eligibility Charts

About School Choice in Wisconsin

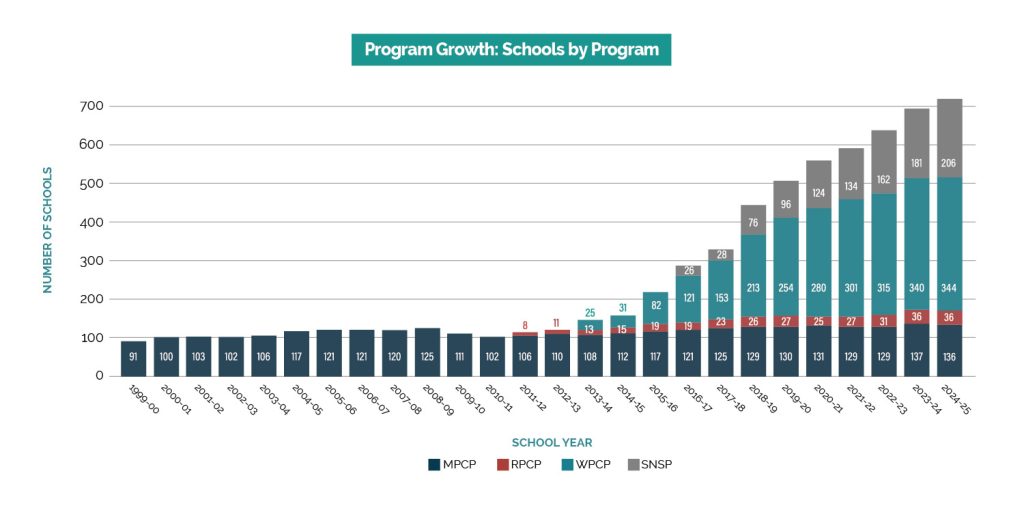

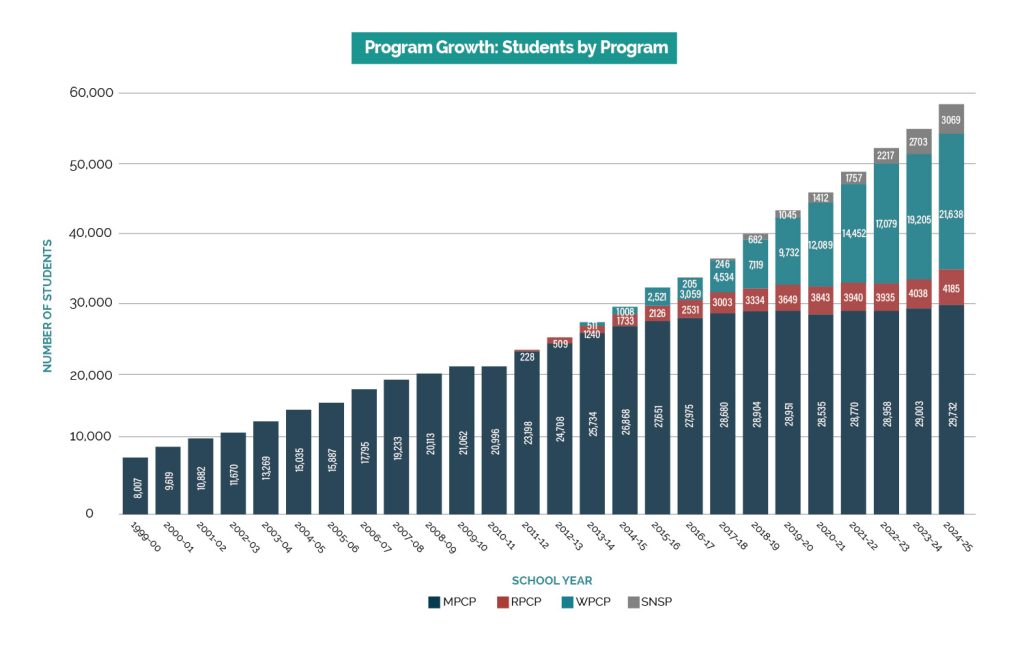

Wisconsin is home to four parental choice programs – the Milwaukee Parental Choice Program (MPCP), the Racine Parental Choice Program (RPCP), the Wisconsin Parental Choice Program (WPCP), and the Special Needs Scholarship Program (SNSP).

The Milwaukee Parental Choice Program was created in 1990 to provide educational freedom and choice to low-income parents in Milwaukee who did not have the financial means to send their children to private schools.

Wisconsin school choice grew through the creation of the Racine Parental Choice program in 2011, the statewide Wisconsin Parental Choice Program in 2013 and the Special Needs Scholarship Program in 2015. Today, Wisconsin’s four school choice programs serve over 60,000 children.

Wisconsin School Choice Program FAQ

WI Supreme Court: Jackson v Benson (June 10, 1998)

- WI Supreme Court upheld the Milwaukee Parental School Choice Program as constitutional and determined the program did not violate the requirement for public schools – the program only adds options for parents.

U.S. Supreme Court: Zelman v Simmons-Harris (June 27, 2002)

- U.S. Supreme Court upheld a Cleveland, Ohio, program as constitutional and determined it was not in violation of the First Amendment or the Establishment Clause.

- Under the Private Choice Test developed by the court, a voucher program must meet all of the following criteria to be considered constitutional:

- Program must have a valid secular purpose.

- Aid must go to parents and not directly to the schools.

- A broad class of beneficiaries must be covered.

- Program must be neutral with respect to religion (opt out).

- There must be adequate nonreligious options.

U. S. Supreme Court: Espinoza v Montana (January 22, 2020)

- Prohibiting religious schools from publicly funded education programs violates the First Amendment, Free Exercise Clause of the U.S. Constitution.

- Held: The application of the no-aid provision discriminated against religious schools and the families whose children attend or hope to attend them in violation of the Free Exercise Clause of the Federal Constitution. Pp. 6–22.

- (a) The Free Exercise Clause “protects religious observers against unequal treatment” and against “laws that impose special disabilities on the basis of religious status.” Trinity Lutheran Church of Columbia, Inc. v. Comer, 582 U. S. ___, ___. In Trinity Lutheran, this court held that disqualifying otherwise eligible recipients from a public benefit “solely because of their religious character” imposes “a penalty on the free exercise of religion that triggers the most exacting scrutiny.”

U.S. Supreme Court: Carson v Makin (June 21, 2022)

- The court ruled that states that offer school choice programs must include private religious schools in their programs.

Schools participating in the parental choice programs are held accountable by regulations and procedures legally required by the Department of Public Instruction, and more importantly parents. EdChoice (formerly known as the Friedman Foundation for Educational Excellence) released a report in May of 2014 entitled, Public Rules on Private Schools: Measuring the Regulatory Impact of State Statutes and School Choice Programs which deemed the MPCP the most regulated school choice program in the country.

Additionally, stricter guidelines are in place for first time, “start-up” schools looking to participate in the program. In the early years, it was too easy for new start-up schools to join the program, resulting in many compliance-related terminations. Since 2013, Act 237 requires new schools to follow a longer timeline, and no new schools have been terminated from the program since its passage.

Financial transparency is required of schools participating in the parental choice programs through an independent GAAP audit. Schools must submit detailed budgets, prove financial viability, and attend fiscal training sessions prior to joining the program. Each year, schools are required to undergo this audit in order to show how voucher dollars are being spent and to make sure that the money is going toward educational expenses only. Schools must attest for every penny for every child, every year.

Schools participating in the program must also attain accreditation by an independent agency or obtain pre-accreditation prior to joining the program. Accreditation requires schools to have degreed or licensed teachers, appropriate curriculum, accountable board governance, maintenance of student records, and a school environment conducive to learning. Choice schools must also have valid occupancy permits, offer the same number of hours of instruction as public schools, abide by the same health and safety requirements as public schools, and comply with non-discrimination provisions of the Civil Rights Act of 1964 (i.e. race, color, or national origin).

If at any time DPI finds that a school in the program is not abiding by these regulations, the school can have its funds withheld until compliance is met or be immediately terminated from the program.

For the RPCP and WPCP, per student payments for continuing students (students who first participated in the 2014 – 2015 school year or prior) are fully funded through state General Purpose Revenue (GPR). Payments for incoming students (students who first participated in the 2015 – 2016 school year or later) are funded through a reduction in the state aid that would otherwise be paid to those students’ school districts of residence. Because most districts’ state aid per child funding is less than the voucher or open enrollment transfer amount, the districts are allowed to levy property taxes for the difference. The SNSP is also funded in this way.

To make up for the aid reduction for incoming students, school districts receive a revenue limit adjustment for each student in the current year equal to the aid reduction. If a school district chooses to levy to the maximum, its total resources are unaffected by the choice aid reduction, because it replaced the aid reduction with local levy. School districts also include incoming students in their student count for membership in calculating state general aid.

Compared to the public school student, the choice student saves taxpayers money. The voucher amount for the MPCP, RPCP, and WPCP is less than public school districts spend to educate their students; resulting in a lower tax impact.

The property tax impact of the WPCP can be viewed on an interactive Wisconsin School Financing Map using the DPI school financing data.

The MPCP is funded differently than the other programs. This program is funded exclusively through state GPR. Under the program, payments to private schools are made from a sum-sufficient GPR appropriation. To partially offset the cost of the program, an aid reduction is made to the aid that would otherwise be paid to MPS equal to a percentage of the total cost of the program. MPS is given levy authority to match a reduction in state aid. In the 2018 – 2019 school year, 19.2% of the voucher had an impact on local property taxes. This will be reduced by 3.2% over the next six years (2024 – 2025) when Milwaukee property taxpayers will not see an impact of the voucher.

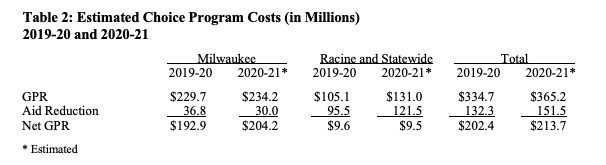

The estimated total cost of the MPCP, RPCP, and WPCP is depicted by the Legislative Fiscal Bureau in the table below:

As part of the state accountability system, the DPI produces report cards for every publicly funded school and district in Wisconsin, including schools participating in the choice program. These accountability report cards include data on multiple indicators for multiple years across four priority areas (student achievement, growth, closing gaps, and on-track and post-secondary success).

In Milwaukee and Racine, schools in the choice program outrank their public school counterparts in the overall accountability score. While only 49% of MPS schools meet or exceed expectations, 68% of MPCP schools meet or exceed expectations. And in Racine, 77% of RPCP schools meet or exceed expectations while only 46% of RUSD schools meet or exceed expectations. WPCP schools have seen growth in their school report cards from last year and have improved their overall accountability ratings for 2017 – 2018. The percentage of WPCP schools meeting or exceeding expectations grew from 54% in 2016 – 2017 to 69% in 2017 – 2018.

The accountability ratings of Milwaukee schools—public, charter, and choice—can be viewed on an interactive map by the Metropolitan Milwaukee Association of Commerce (MMAC) using data from the DPI report cards.

Each year, schools participating the choice program are required to administer the same state assessments to their choice students as their public school counterparts:

- The Wisconsin Forward Exam for English Language Arts and Mathematics for students in grades 3-8

- The Wisconsin Forward Exam for Science for students in grades 4 and 8

- The Wisconsin Forward Exam for Social Studies for students in grades 4, 8 and 10

- The ACT Aspire for students in grades 9 and 10

- The ACT and ACT WorkKeys for students in grade 11

The Wisconsin Forward Exam is designed to gauge how well students are doing in relation to the Wisconsin Academic Standards. These standards outline what students should know and be able to do in order to be college and career ready. The ACT is the leading national college admissions test that evaluates college readiness based on the scored areas of English, reading, math, science, and writing.

Through these state assessments, the academic performance of choice students can be directly compared to the performance of their public school counterparts. For the past three years, choice students have consistently outperformed their peers on the ACT.

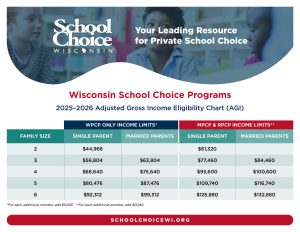

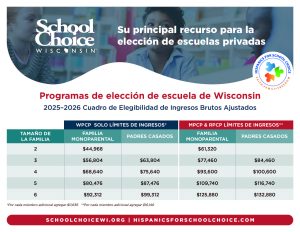

To see the adjusted gross income requirements for the WPCP, MPCP and RPCP programs, please visit our Income Chart page, updated annually.

Skip to content

Skip to content